The UW- River Falls Center for Economic Research (CER) in partnership with St. Croix Economic Development Corporation (SCEDC) has released the May 2011 edition of the St. Croix Valley Economic Dashboard. The dashboard is a snapshot of the economic condition of the labor, consumer and housing markets in the three county St. Croix Valley. It presents the latest available data* in one convenient package and can be viewed on the CER's website at www.uwrf.edu/cer.

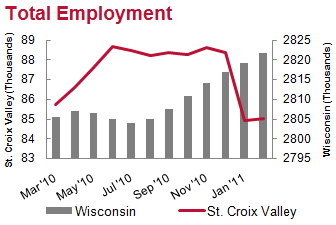

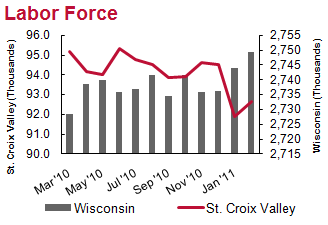

The unemployment rate declined in the Valley for the first time since October ‘10, indicating that the recovery of the job market may be picking up steam. The unemployment was driven lower by the first increase in total employment since June ‘10. This combined with national employment number, the nation created 244,000 jobs in April ‘11, provide strong evidence that job market conditions will continue to improve. However, the unemployment rate in the Valley, at 7.9 percent, is still above the state unemployment rate of 7.4%.

Ironically, the lower unemployment rate is currently posing one of the biggest risks to the economic recovery in Wisconsin. As of April 16th, Wisconsin claimants no longer qualify for unemployment benefits under the Federal Extended Benefits Program (See the Wisconsin Department of Workforce Development for more information). While regular and emergency unemployment programs are still in effect, many unemployed Wisconsinites either have exhausted their unemployment benefits or will exhaust them soon.

Losing one dollar of unemployment benefits translates into a lose of more than one dollar in aggregate spending because of the spending multiplier effect. Thus, as unemployment benefits are exhausted the already slow pace of recovery could slow even further. In the Valley, county sales tax revenues have been declining since September ‘10 in declining sales tax revenue, which indicates decreasing aggregate spending in the region.

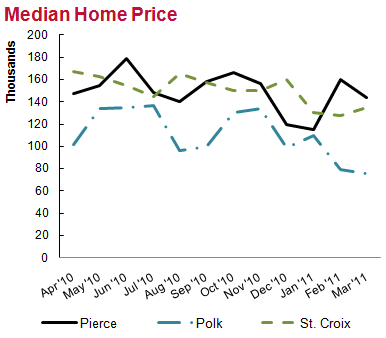

The housing market remains grim. In April, median home price in the Valley declined 14.5 percent from one year ago to about $130,000, and the S&P Case-Shiller Home Price Index for the Minneapolis metropolitan statically area has declined for nine consecutive months (the latest release of the S&P Case-Shiller Home Price Index was in February). In fact, the national S&P Case-Shiller Home Price Index for February is at its lowest point since the height of the hosing market collapse. Slow progress processing foreclosures, high inventories of unsold homes and the ending of the homebuyer tax credit are contributing to housing market weakness.

Wisconsin's St. Croix Valley is comprised of St. Croix, Polk, and Pierce counties. All three counties are located along the Wisconsin-Minnesota border. Two of the three counties, St. Croix and Pierce, are included in the Minneapolis-St. Paul-Bloomington MN-WI metropolitan area, a 13-county region with of population of 3.25 million residents. For additional information on the May edition of the St. Croix Valley Economic Dashboard, contact Dr. Logan Kelly at cer@uwrf.edu or (715) 425-4993 or William Rubin at bill@stcroixedc.com or (715) 381-4383.

*Please note that most regional data is available with between a one and two month delay, thus the current month's dashboard will have data from previous months.

*Please note that most regional data is available with between a one and two month delay, thus the current month's dashboard will have data from previous months.